When I first saw the total cost for my kid’s hockey season, I nearly fainted. Did you know that according to USA Hockey, the average family spends between $3,000 to $7,000 per child per season on youth hockey?

As a fellow hockey parent who’s been navigating these icy financial waters for years, I’m here to share some hard-earned wisdom. With a bit of planning and some clever moves, you can keep your budgeting goals and your child’s hockey dreams alive. So, grab your favorite beverage (maybe something stronger than coffee for this one!), and let’s dive into the world of balancing bank accounts and breakaways.

Understanding the Full Cost of Youth Hockey

So what goes into the cost of a hockey season? Let’s take a look:

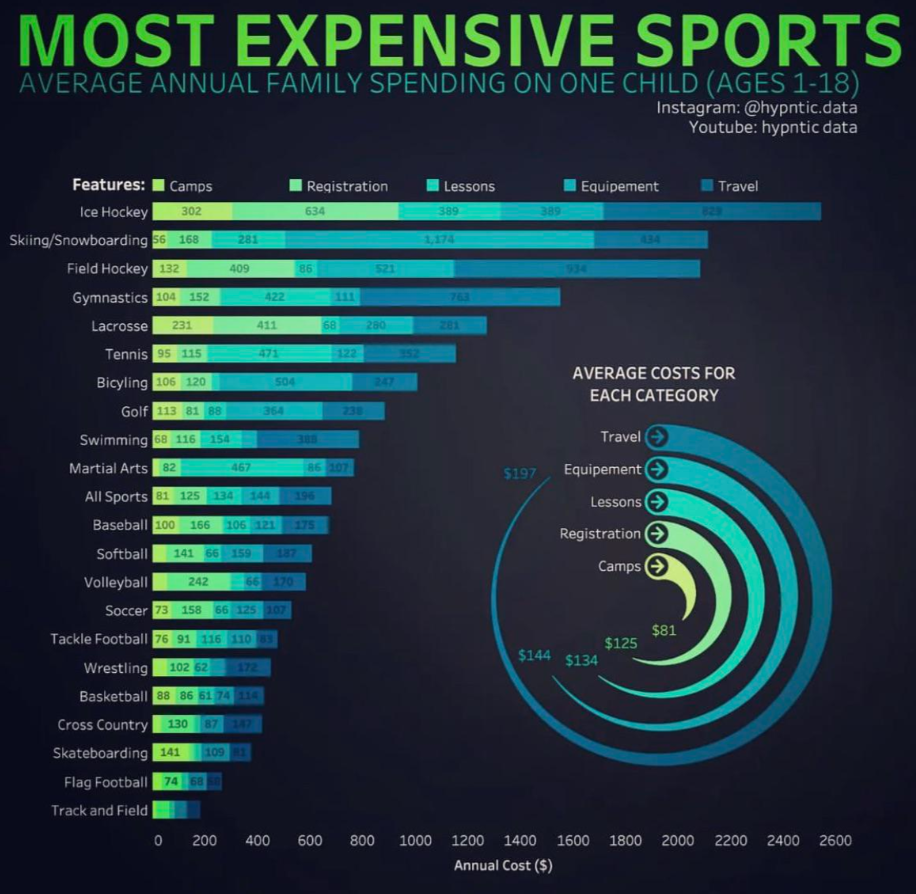

- The big-ticket items: Registration fees, ice time, and equipment. These are your major expenses, folks.

- Travel costs: Gas, hotels, meals on the road. It adds up fast!

- Hidden costs: Team apparel, tournament fees, extra training sessions. These sneaky expenses can blindside your budget.

- Level of play matters: House league might set you back $1,000-$3,000, while AAA… well, let’s just say you might need to refinance your house.

Pro tip: Start a spreadsheet to track ALL hockey-related expenses. You might be surprised (or terrified) by the total, but knowledge is power, right?

Creating a Hockey-Specific Budget

Now that we’ve faced our fears, let’s create a game plan:

- Integrate hockey into your family budget. We use the “envelope system” – one envelope for each expense category.

- Budgeting apps are your friends. I swear by YNAB (You Need A Budget) for tracking our hockey madness.

- Set up a dedicated hockey savings account. We auto-transfer a set amount each payday. It’s like a penalty box for our money – it stays put!

- Think seasonally. Our family budget looks different during hockey season. We cut back on other areas to make it work (sorry, fancy restaurants).

Remember, a good budget is like a good defenseman – flexible but strong!

Equipment Strategies: Balancing Quality and Cost

Ah, equipment. The black hole of hockey budgets. But fear not! Here’s how to gear up without going broke:

- Invest in key items: Skates and helmets are non-negotiable for new, properly fitted gear.

- Go used for the rest: Sideline Swap is my second home during growth spurts.

- Timing is everything: Shop end-of-season sales for next year’s gear.

- Swap meets are gold mines: Our organization hosts an annual equipment swap. It’s like Christmas for hockey parents!

- Facebook Groups: Join Hockey Parent pages to find opportunities to buy used equipment.

Remember, your kid doesn’t need pro-level gear to have fun and develop skills. Save the top-shelf stuff for when they make the NHL!

Travel and Tournament Expenses: Planning Ahead

Road trips: where memories are made and wallets are emptied. But it doesn’t have to be that way:

- Budget for travel from day one. We set aside a little each month for those weekend tournaments.

- Become a hotel hacker: Loyalty programs, group bookings, and off-peak travel can save big bucks. Join the rewards program for every hotel chain you stay at.

- Pack snacks like you’re preparing for hibernation. It’s cheaper and healthier than constant drive-thrus.

Bonus tip: We use a travel rewards credit card for all hockey expenses. Hello, free flights to tournaments!

Fundraising and Sponsorships: Easing the Financial Burden

Time to get creative and teach some entrepreneurial skills:

- Team fundraisers can be gold mines: Our bottle drive last year covered tournament fees for the whole team!

- Individual sponsorships aren’t just for pros: Local businesses often love supporting young athletes.

- Harness the power of social media: A friend ran a GoFundMe campaign for championship travel and it was a huge success.

- Involve the kids: My daughter sells homemade hockey-themed crafts at games. She’s learning business skills and contributing to her hockey fund!

Remember, fundraising isn’t just about money – it’s about community building and teaching valuable life skills.

Maximizing Tax Benefits and Financial Aid

Uncle Sam might be able to help ease the pain:

- Some hockey expenses might be tax-deductible. Consult a tax professional!

- Some leagues offer financial aid. Don’t be too proud to ask – that’s what it’s there for.

- Look into hockey scholarships and grants. USA Hockey Foundation offers several options.

- Keep every receipt! Future you will thank present you during tax season.

Balancing Hockey Costs with Other Family Financial Goals

Hockey is important, but so is, you know, the rest of your life:

- Don’t sacrifice retirement savings for hockey. Your kid can get a college scholarship, not for your retirement!

- Have open conversations with your partner about hockey expenses. Financial transparency is key to marital harmony (and sanity).

- Use hockey as a tool to teach financial literacy. Involve your athlete in budgeting discussions.

- Regularly reassess your commitment. It’s okay to take a season off if finances are tight.

Budgeting for youth hockey can be daunting, but with these strategies, you can keep your financial goals and your child’s hockey dreams alive.

Remember, at the end of the day, hockey is about more than just winning games. It’s about the life lessons, the friendships, and yes, even the budgeting skills that will serve your child well into adulthood.

So the next time you write that painfully large check for tournament fees or scour the internet for deals on elbow pads at 2 AM, take a deep breath. You’re not just funding a hobby but investing in your child’s physical health, mental well-being, and future success.